A Comprehensive Forecast of the Lithium Market

The lithium market, a cornerstone of the renewable energy and electric vehicle (EV) revolution, is set to undergo significant transformations over the next year. This annual forecast provides an in-depth analysis of the key trends, demand and supply dynamics, technological advancements, and the overall outlook for the lithium market. By understanding these factors, stakeholders can better position themselves in this rapidly evolving landscape.

Recent Trends and Market Performance

1. Price Movements:

- Overview: Lithium prices have experienced notable volatility over the past year, primarily driven by fluctuations in demand from the EV and energy storage sectors.

- Current Prices: As of the end of the last quarter, lithium carbonate prices have hovered around $40,000 per metric ton, showing a significant increase from the previous year due to heightened demand and supply constraints.

2. Demand Growth:

- Electric Vehicles (EVs): The primary driver of lithium demand is the EV market. Global EV sales have surged, with major markets like China, Europe, and the United States leading the charge. EV manufacturers are ramping up production to meet ambitious sales targets and government mandates for zero-emission vehicles.

- Energy Storage Systems: The integration of renewable energy sources into the power grid necessitates efficient energy storage solutions, boosting demand for lithium-ion batteries. Both residential and grid-scale storage systems are contributing to this demand.

3. Supply Dynamics:

- Production Capacity: Despite increased investment in lithium mining and production, supply has struggled to keep pace with demand. Key producers like Australia, Chile, and Argentina are ramping up production, but logistical challenges and regulatory hurdles remain.

- New Projects: Several new lithium projects are in the pipeline, aiming to alleviate supply constraints. These include expansions of existing mines and the development of new sources in Africa and North America.

Key Drivers and Market Dynamics

1. Government Policies and Incentives:

- Subsidies and Mandates: Governments worldwide are offering subsidies and implementing mandates to accelerate the adoption of EVs and renewable energy. Policies aimed at reducing carbon emissions are pivotal in driving lithium demand.

- Environmental Regulations: Stricter environmental regulations are encouraging the use of cleaner energy storage solutions, further boosting lithium demand.

2. Technological Advancements:

- Battery Technology: Innovations in lithium-ion battery technology, including improvements in energy density, charging speed, and battery lifespan, are enhancing the attractiveness of lithium-based batteries. Research into alternative lithium chemistries, such as solid-state batteries, is also gaining momentum.

- Recycling and Sustainability: Advances in battery recycling technology are crucial for ensuring a sustainable supply chain. Efficient recycling processes can recover significant amounts of lithium, reducing dependency on mining.

3. Market Sentiment and Investment:

- Investor Interest: The lithium market has attracted substantial interest from investors, driven by the long-term growth prospects of the EV and renewable energy sectors. Investment in lithium mining companies, battery manufacturers, and related technologies is robust.

- Corporate Strategies: Major corporations, including automakers and tech giants, are securing lithium supply through long-term contracts and strategic partnerships, ensuring stable supply chains.

Demand and Supply Projections

1. Demand Projections:

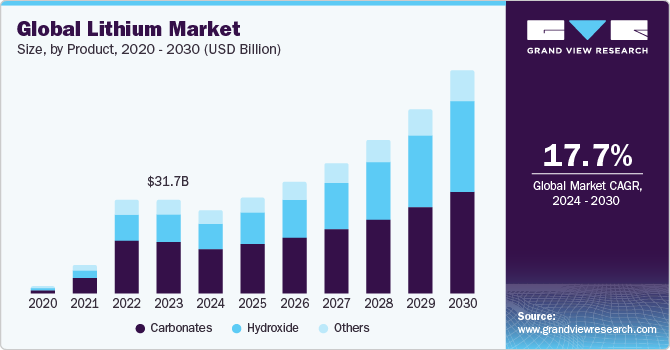

- Global Demand: Global lithium demand is projected to grow at a compound annual growth rate (CAGR) of approximately 20-25% over the next decade. The EV sector is expected to account for the majority of this demand, followed by energy storage systems and consumer electronics.

- Regional Demand: China remains the largest consumer of lithium, driven by its dominant position in the EV market. Europe and North America are also witnessing rapid growth in lithium demand due to supportive government policies and increasing EV adoption.

2. Supply Projections:

- Production Increases: Major lithium producers are expected to increase production capacity significantly. Australia, the world’s largest lithium producer, is planning substantial expansions. New projects in Argentina and North America are also anticipated to come online within the next few years.

- Potential Bottlenecks: Despite planned expansions, potential bottlenecks in the supply chain, such as regulatory delays, logistical challenges, and environmental concerns, could impact the timely availability of lithium.

Future Outlook and Challenges

1. Market Balance:

- Short-term Tightness: In the short term, the lithium market may experience supply tightness due to surging demand and slower-than-expected production increases. This could lead to sustained high prices and intensified competition for supply.

- Long-term Equilibrium: Over the long term, as new production capacity comes online and recycling technologies improve, the market is expected to achieve better balance. Prices may stabilize, but the overall demand trajectory remains upward.

2. Technological Breakthroughs:

- Solid-state Batteries: The development and commercialization of solid-state batteries, which offer higher energy density and improved safety, could significantly impact the lithium market. While still in the research phase, successful breakthroughs could reshape demand dynamics.

- Alternative Chemistries: Research into alternative battery chemistries, such as lithium-sulfur and sodium-ion, could diversify the battery market. However, lithium-ion batteries are expected to remain dominant for the foreseeable future.

3. Sustainability and Environmental Impact:

- Environmental Concerns: Mining and processing lithium have environmental impacts, including water usage and habitat disruption. Ensuring sustainable and ethical production practices is crucial for long-term industry viability.

- Recycling Initiatives: Scaling up recycling efforts is essential for reducing environmental impact and securing a stable supply of lithium. Investment in recycling infrastructure and technology will play a vital role.

Conclusion

The lithium market is poised for significant growth, driven by the accelerating adoption of electric vehicles and renewable energy storage solutions. While supply constraints and market volatility present challenges, ongoing investments in production capacity and technological advancements offer promising prospects. Stakeholders in the lithium market should remain vigilant to the evolving dynamics, including government policies, technological breakthroughs, and sustainability initiatives, to capitalize on the opportunities in this vibrant and critical industry.

As the world transitions towards cleaner energy, lithium will continue to play a pivotal role in powering the future, making it an essential focus for investors, policymakers, and industry leaders alike.