A Comprehensive Review of the Diamond Market

The diamond market, known for its allure and enduring value, has experienced dynamic shifts in the past quarter. This review provides an in-depth analysis of recent trends, key drivers, and future outlooks for the diamond industry. By understanding these factors, stakeholders can better navigate the complexities of this glittering market.

Recent Trends in the Diamond Market

1. Price Movements:

- Overall Performance: Over the past quarter, diamond prices have shown a stable upward trend. The price of rough diamonds increased by approximately 5%, reflecting steady demand and constrained supply.

- Price Variations: Prices for high-quality, larger diamonds have seen significant appreciation, while smaller and lower-quality stones have experienced more modest gains.

2. Demand and Supply Dynamics:

- Consumer Demand: Demand for diamonds, particularly in the luxury jewelry segment, has remained strong. Key markets like the United States, China, and India have shown robust consumer interest, driven by economic recovery and festive seasons.

- Supply Constraints: The supply of rough diamonds has been relatively tight due to limited production from major mining companies and ongoing disruptions caused by geopolitical issues and pandemic-related restrictions.

3. Market Segments:

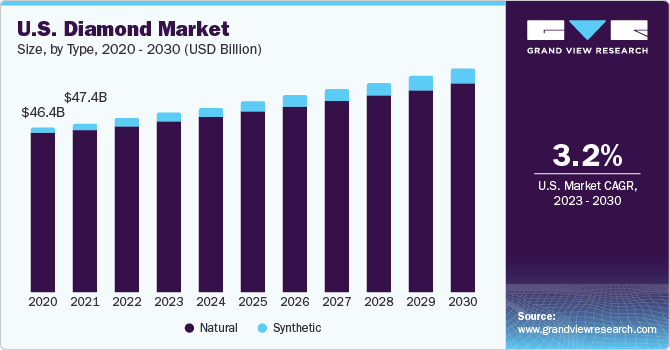

- Natural Diamonds: The market for natural diamonds continues to dominate, with steady demand from traditional buyers and investors seeking tangible assets.

- Lab-Grown Diamonds: Lab-grown diamonds are gaining traction, especially among environmentally conscious consumers and those seeking affordable alternatives. This segment has seen double-digit growth, though it still represents a smaller share of the overall market.

Key Drivers of Diamond Market Trends

1. Economic Recovery:

- The global economic recovery, post-pandemic, has positively impacted consumer spending on luxury goods, including diamonds. Increased disposable income and pent-up demand have driven sales, especially during key buying seasons.

2. Geopolitical Stability:

- Geopolitical stability in diamond-producing regions, such as Africa and Russia, is crucial for maintaining a steady supply. Recent conflicts and sanctions have posed challenges, influencing supply dynamics and pricing.

3. Marketing and Branding:

- Effective marketing campaigns by major diamond companies and retailers have bolstered consumer confidence and demand. Branding efforts emphasizing sustainability and ethical sourcing have particularly resonated with younger consumers.

4. Technological Advancements:

- Innovations in diamond cutting and polishing techniques have enhanced the quality and appeal of diamonds. Additionally, advancements in lab-grown diamond production have improved their quality and market acceptance.

5. Regulatory Environment:

- Regulatory changes and initiatives aimed at ensuring transparency and ethical practices in the diamond supply chain have impacted market operations. Compliance with standards such as the Kimberley Process remains a critical factor.

Market Sentiment and Speculative Activity

1. Investor Sentiment:

- Investor sentiment towards diamonds has been positive, driven by their status as a hedge against inflation and economic uncertainty. Diamonds, being tangible assets, offer stability and long-term value.

2. Speculative Positioning:

- Speculative activity in the diamond market has increased, with investors showing interest in both natural and lab-grown diamonds. This has been influenced by rising prices and the potential for further appreciation.

Future Outlook

1. Economic Indicators to Watch:

- Consumer Spending: Monitoring trends in consumer spending and economic indicators such as GDP growth, employment rates, and inflation will provide insights into future demand for diamonds.

- Global Trade Policies: Changes in trade policies, tariffs, and regulations affecting diamond imports and exports will impact market dynamics and pricing.

2. Technological Innovations:

- Continued advancements in lab-grown diamond technology will influence the market. Improved production techniques and increased consumer acceptance may drive growth in this segment.

3. Sustainability and Ethical Sourcing:

- Increasing consumer awareness and demand for sustainably sourced and ethically produced diamonds will shape market trends. Companies investing in transparent and ethical supply chains will likely gain a competitive edge.

4. Geopolitical Developments:

- Geopolitical stability in key diamond-producing regions will remain a critical factor. Any disruptions due to conflicts or sanctions can affect supply and pricing significantly.

5. Industry Collaborations:

- Collaborations between diamond producers, retailers, and technology providers can drive innovation and market growth. Joint efforts to enhance transparency, traceability, and consumer engagement will be pivotal.

Conclusion

The diamond market has shown resilience and adaptability in the past quarter, with stable price increases and robust demand. Economic recovery, consumer confidence, and technological advancements are key drivers shaping the market. As the industry evolves, sustainability and ethical practices will become increasingly important, influencing consumer preferences and market operations.

Looking ahead, stakeholders should keep a close watch on economic indicators, technological developments, and geopolitical stability to navigate the market effectively. By understanding and adapting to these trends, businesses can capitalize on opportunities and ensure long-term success in the sparkling world of diamonds.