The Power Players: Understanding OPEC’s Influence in the Global Oil Market

The Organization of the Petroleum Exporting Countries (OPEC) has been a central player in the global oil market for over six decades. As a consortium of major oil-exporting nations, OPEC’s primary mission is to coordinate and unify petroleum policies among member countries, ensuring stable oil markets and fair returns on investments. This blog explores OPEC’s role in shaping the global oil landscape, its influence on oil prices, and its strategic responses to market challenges.

The Formation and Evolution of OPEC

OPEC was established in 1960 by five founding members: Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela. Over the years, the organization has expanded to include 13 member countries, primarily from the Middle East, Africa, and South America. OPEC’s headquarters is in Vienna, Austria.

Core Objectives of OPEC

OPEC aims to:

- Stabilize Oil Markets: By coordinating production levels, OPEC seeks to avoid excessive fluctuations in oil prices, ensuring a stable supply for consumers and fair returns for producers.

- Secure Fair Prices: OPEC strives to achieve a balanced and fair price for oil, which is beneficial for both producers and consumers.

- Manage Oil Supply: Through production quotas and collective agreements, OPEC manages the supply of oil to align with global demand, preventing oversupply or shortages.

Mechanisms of Influence

1. Production Quotas:

- OPEC sets production targets for its member countries, adjusting output levels to influence global oil supply and stabilize prices. These quotas are determined based on market conditions, economic forecasts, and geopolitical considerations.

2. Market Monitoring:

- OPEC continuously monitors global oil markets, analyzing data on supply, demand, inventories, and price trends. This information guides the organization’s decisions on production adjustments and market interventions.

3. Collaborative Agreements:

- In recent years, OPEC has collaborated with non-OPEC oil-producing countries, forming the OPEC+ alliance. This broader coalition, which includes major producers like Russia, aims to enhance market stability through coordinated production cuts or increases.

Impact on Oil Prices

OPEC’s decisions on production levels have a significant impact on global oil prices:

- Supply Cuts: When OPEC reduces production, it decreases the global supply of oil, which typically leads to higher prices if demand remains constant or increases.

- Supply Increases: Conversely, when OPEC increases production, it can lead to an oversupply of oil, resulting in lower prices if demand does not keep pace.

Geopolitical Influence

OPEC’s actions are often influenced by geopolitical factors, including:

- Regional Conflicts: Political instability and conflicts in key oil-producing regions can disrupt production and supply, prompting OPEC to adjust output to stabilize markets.

- Sanctions and Trade Policies: International sanctions and trade policies affecting member countries, such as those imposed on Iran and Venezuela, can impact production levels and market dynamics.

- Global Economic Conditions: Economic growth or recession in major economies influences oil demand, prompting OPEC to adjust production to maintain market balance.

Challenges and Criticisms

OPEC faces several challenges and criticisms:

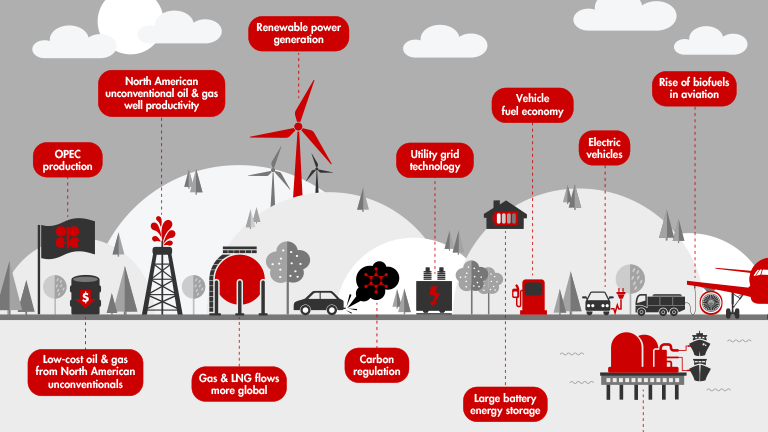

- Market Share and Competition: The rise of shale oil production, particularly in the United States, has increased competition and reduced OPEC’s market share. Technological advancements in extraction have made non-OPEC oil more accessible and economically viable.

- Internal Disagreements: Differences in economic priorities and production capacities among member countries can lead to internal conflicts and difficulties in reaching consensus on production targets.

- Environmental Concerns: Global efforts to combat climate change and transition to renewable energy sources pose long-term challenges to OPEC’s relevance and influence in the global energy market.

Strategic Adaptations

To address these challenges, OPEC has adopted several strategic adaptations:

- OPEC+: The formation of the OPEC+ alliance has strengthened OPEC’s influence by including major non-OPEC producers in production agreements, enhancing the organization’s ability to stabilize markets.

- Diversification Efforts: Some OPEC member countries are investing in economic diversification and renewable energy to reduce their dependence on oil revenues and adapt to changing energy landscapes.

- Market Flexibility: OPEC has shown increased flexibility in responding to market conditions, adjusting production targets more frequently and engaging in dialogue with key stakeholders to maintain market stability.

Conclusion

OPEC’s role in the global oil market is multifaceted, involving strategic production management, market monitoring, and geopolitical navigation. Despite facing significant challenges, OPEC continues to exert considerable influence over oil prices and market stability. By understanding OPEC’s mechanisms of influence and strategic responses, stakeholders can better anticipate market trends and make informed decisions in the dynamic world of global oil. As the energy landscape evolves, OPEC’s ability to adapt and collaborate will be crucial in maintaining its relevance and effectiveness in shaping the future of energy markets.

4o

Future of Oil in Energy TransitionChatGPT

Title: The Future of Oil in the Energy Transition: Navigating a Shifting Landscape

Headline: Transitioning Tides: The Role of Oil in the Emerging Energy Paradigm

As the world faces the urgent need to combat climate change, the energy sector is undergoing a transformative shift towards cleaner and more sustainable sources. However, the future of oil in this energy transition remains a complex and nuanced topic. While renewable energy technologies are rapidly advancing, oil continues to play a significant role in the global energy mix. This blog explores the evolving role of oil in the energy transition, the challenges and opportunities it presents, and the strategies oil companies are adopting to adapt to a greener future.

The Current Landscape

1. Persistent Demand:

- Despite the push towards renewables, global demand for oil remains substantial. Oil is not only a primary fuel for transportation but also a critical feedstock for various industrial processes, including the production of plastics, chemicals, and pharmaceuticals.

2. Economic Dependencies:

- Many countries, particularly those in OPEC, heavily rely on oil revenues for their economic stability. The transition away from oil presents significant economic challenges for these nations, necessitating careful planning and diversification.

Drivers of the Energy Transition

1. Climate Change Mitigation:

- Global efforts to reduce carbon emissions and limit global warming are driving the transition towards renewable energy sources like solar, wind, and hydroelectric power. International agreements, such as the Paris Agreement, set ambitious targets for reducing greenhouse gas emissions, pressuring countries and companies to adopt cleaner energy practices.

2. Technological Advancements:

- Innovations in renewable energy technologies and energy storage solutions are making renewables more competitive with traditional fossil fuels. Advances in electric vehicles (EVs), for example, are reducing the demand for gasoline and diesel.

3. Policy and Regulation:

- Governments worldwide are implementing policies and regulations to support the energy transition. These include subsidies for renewable energy projects, carbon pricing mechanisms, and stricter emissions standards for vehicles and industrial processes.

The Evolving Role of Oil

1. Transition Fuel:

- Natural gas, often seen as a bridge fuel in the transition to renewables, is a byproduct of oil extraction. It is cleaner than coal and oil, emitting fewer pollutants and greenhouse gases when burned. In this way, oil and its associated natural gas can play a transitional role in the energy shift.

2. Focus on Efficiency:

- Improving energy efficiency in oil extraction, refining, and consumption can reduce the carbon footprint of oil. Enhanced oil recovery techniques and more efficient combustion engines are examples of how the industry can minimize environmental impact.

3. Petrochemicals:

- The demand for petrochemicals, derived from oil, is expected to grow, driven by sectors like plastics, synthetic materials, and pharmaceuticals. Even as energy consumption shifts towards renewables, the petrochemical industry will continue to rely on oil as a key input.

Challenges for the Oil Industry

1. Stranded Assets:

- As the world shifts towards cleaner energy, there is a risk that oil reserves and infrastructure investments could become stranded assets—resources that are no longer economically viable to exploit.

2. Market Volatility:

- The transition to renewable energy sources introduces new market dynamics, leading to potential volatility in oil prices. Fluctuations in demand and supply can create economic uncertainties for oil-dependent economies and companies.

3. Regulatory Pressure:

- Increasing regulatory pressure to reduce carbon emissions and environmental impact poses a significant challenge for the oil industry. Companies must navigate complex regulatory landscapes and invest in cleaner technologies to remain compliant.

Strategic Adaptations by Oil Companies

1. Diversification:

- Many oil companies are diversifying their portfolios by investing in renewable energy projects, such as wind, solar, and biofuels. This strategy helps mitigate risks associated with declining oil demand and positions them for future growth in the renewable sector.

2. Carbon Capture and Storage (CCS):

- Investing in CCS technologies allows oil companies to reduce their carbon footprint by capturing and storing carbon emissions from their operations. This approach aligns with global emissions reduction targets and enhances the sustainability of oil production.

3. Innovation and Research:

- Continuous investment in research and development is crucial for oil companies to innovate and stay competitive. Exploring new technologies for cleaner extraction, refining processes, and alternative uses for hydrocarbons can drive the industry’s evolution.

4. Strategic Partnerships:

- Forming strategic partnerships with renewable energy companies and other stakeholders can facilitate knowledge exchange and collaborative efforts in the energy transition. Joint ventures and alliances can accelerate the development of integrated energy solutions.

Conclusion

The future of oil in the energy transition is characterized by both challenges and opportunities. While the global shift towards renewable energy is inevitable, oil will continue to play a role in the energy mix for the foreseeable future. The key to navigating this transition lies in adaptability, innovation, and strategic foresight. By embracing cleaner technologies, diversifying investments, and aligning with global sustainability goals, the oil industry can contribute to a balanced and resilient energy future. As the world moves towards a greener horizon, the evolution of oil’s role will be a testament to the dynamic and ever-changing landscape of global energy.