Geopolitical Events and Their Impact on Gold Prices: A Comprehensive Guide

Gold is often considered a safe-haven asset, meaning its price tends to rise during times of geopolitical instability or uncertainty. Understanding how geopolitical events influence gold prices can help investors make informed decisions. Here’s an in-depth look at the relationship between geopolitical events and gold prices:

1. Nature of Geopolitical Events Affecting Gold Prices

Wars and Military Conflicts:

- Increased Demand for Safe Havens: During wars or military conflicts, investors seek refuge in safe-haven assets like gold, leading to increased demand and higher prices.

- Supply Disruptions: Conflicts in gold-producing regions can disrupt mining operations, reducing supply and pushing prices up.

Political Instability:

- Government Crises: Political turmoil, such as coups, revolutions, or unstable governments, can erode investor confidence in national currencies and financial systems, driving demand for gold.

- Policy Changes: Uncertain or radical policy changes, especially those related to monetary policy, can lead to a shift towards gold as a protective measure.

International Sanctions:

- Economic Isolation: Sanctions can isolate countries economically, leading them to rely more on gold for international trade and as a store of value.

- Currency Devaluation: Sanctions often result in currency devaluation, prompting affected countries and their citizens to convert their assets into gold.

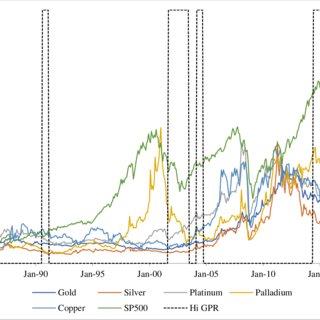

2. Historical Examples of Geopolitical Events Impacting Gold Prices

1970s Oil Crisis and Middle East Tensions:

- Gold Prices Soared: The oil embargo and ensuing geopolitical tensions in the Middle East during the 1970s led to a dramatic increase in gold prices as investors sought stability.

2008 Financial Crisis:

- Flight to Safety: Although primarily an economic event, the 2008 financial crisis had geopolitical ramifications, leading to a surge in gold prices as a safe-haven asset.

US-Iran Tensions (2020):

- Spike in Gold Prices: Escalating tensions between the US and Iran in early 2020 caused a temporary spike in gold prices due to fears of a broader conflict.

Ukraine-Russia Conflict (2022):

- Market Volatility: The invasion of Ukraine by Russia in 2022 led to significant market volatility, with gold prices rising as investors moved to protect their portfolios against geopolitical uncertainty.

3. Mechanisms Through Which Geopolitical Events Influence Gold Prices

Investor Behavior:

- Risk Aversion: In times of geopolitical uncertainty, investors often exhibit risk-averse behavior, shifting their investments from equities and other riskier assets to gold.

- Market Sentiment: Negative news and fear of future instability boost market sentiment towards gold, driving prices up.

Currency Fluctuations:

- USD and Gold Relationship: Gold is typically priced in US dollars. During geopolitical events, if the USD weakens, gold becomes cheaper for investors holding other currencies, increasing demand.

- Safe-Haven Currencies: Events that strengthen safe-haven currencies like the Swiss franc or Japanese yen can also influence gold prices indirectly by altering currency dynamics.

Inflation Expectations:

- Inflation Hedge: Geopolitical events often lead to fears of rising inflation, as governments may increase spending or disrupt supply chains. Gold is seen as a hedge against inflation, boosting its demand.

4. Long-Term vs. Short-Term Effects

Short-Term Effects:

- Immediate Reaction: Gold prices typically react quickly to geopolitical news, with spikes in price often seen immediately following the announcement of significant events.

- Volatility: Short-term price movements can be highly volatile as markets digest new information and investors adjust their positions.

Long-Term Effects:

- Sustained Trends: Prolonged geopolitical instability can lead to sustained higher gold prices as ongoing uncertainty keeps demand elevated.

- Economic Adjustments: Over time, markets and economies may adjust to new geopolitical realities, potentially stabilizing gold prices at new levels.

5. Strategic Implications for Investors

Diversification:

- Portfolio Protection: Including gold in a diversified investment portfolio can provide protection against geopolitical risks and enhance overall portfolio stability.

- Hedging Strategies: Investors may use gold to hedge against potential losses in other asset classes during periods of geopolitical turmoil.

Market Monitoring:

- Stay Informed: Regularly monitor global news and geopolitical developments to anticipate potential impacts on gold prices.

- Responsive Trading: Be prepared to adjust investment strategies in response to changing geopolitical conditions, taking advantage of price movements in gold.

Long-Term Investment Perspective:

- Hold Gold for Stability: Consider holding gold as a long-term investment to guard against unforeseen geopolitical risks and maintain a stable store of value.

- Avoid Speculative Moves: While short-term trading can be profitable, avoid overly speculative moves based on geopolitical events, which can be unpredictable and complex.

Conclusion

Geopolitical events significantly impact gold prices by driving investor behavior, influencing currency markets, and altering inflation expectations. By understanding these dynamics, investors can better navigate the complexities of the gold market and use gold to mitigate risks associated with geopolitical instability. Whether as a short-term safe haven or a long-term investment, gold remains a vital component in a well-rounded investment strategy, offering protection and stability in an unpredictable world.